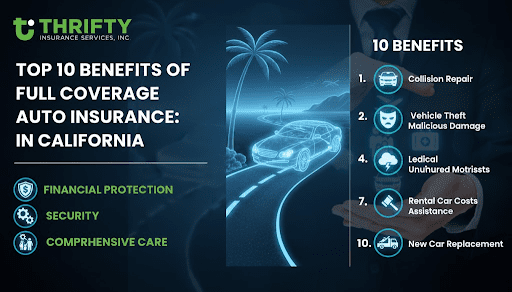

Top 10 Benefits of Full Coverage Car Insurance in California 2026

As we kick off 2026 in California, where urban sprawl meets wildfire-prone hills and electric vehicles zoom past classic convertibles, car insurance isn’t just a checkbox; it’s a lifeline. Full coverage auto insurance goes beyond the state’s minimum requirements of 30/60/15 liability (up from the old 15/30/5 in 2025), bundling in collision and comprehensive protections to safeguard your vehicle from accidents, theft, and nature’s curveballs. With average full coverage premiums at $3,119 annually or about $260 monthly compared to $916 yearly for minimum coverage, it’s pricier but packs serious value in a state with high repair costs and frequent claims. We’ll break it down with stats, real scenarios, and links to help you decide if it’s right for you. For tailored options, check our auto coverage or explore California’s insurance guidelines.

Benefit 1: Comprehensive Protection Against Theft and Vandalism

In a state where car thefts topped 200,000 in 2023 (and trends suggest similar numbers for 2025), full coverage’s comprehensive component shines by covering stolen vehicles or vandalism damage minus your deductible. Unlike minimum liability, which only handles others’ damages, this pays to repair or replace your ride, potentially saving thousands. Imagine your SUV was keyed in a San Francisco parking lot, full coverage could cover the $2,000 repaint without dipping into savings.

Comprehensive claims rose 15% in California post-2020 due to catalytic converter thefts. Pair it with anti-theft discounts for extra savings. Learn more on our discount eligibility tool or via NerdWallet’s theft guide.

Benefit 2: Coverage for At-Fault Collision Damages

Collision coverage, a core of full coverage, steps in when you’re at fault in an accident, footing repair bills regardless of blame. In traffic-jammed California, home to the nation’s worst congestion in LA and SF this averts financial ruin, as average repair costs hit $4,500 per claim. Without it, you’re on the hook, but full coverage keeps you rolling.

Example: A fender-bender on the 405 could cost $3,000 out-of-pocket with minimums, but full coverage caps it at your $500-1,000 deductible. Stat: 40% of California drivers opt to handle rising parts prices. Customize yours through our policy builder or read Bankrate’s collision explainer, Repairer Driven News.

Benefit 3: Safeguards Against Natural Disasters

California’s wildfires, floods, and earthquakes make comprehensive coverage a must; it repairs or replaces vehicles damaged by non-collision events like falling debris or hail. With 2025 seeing over 7,000 wildfires burning millions of acres, claims surged 25%, averaging $10,000 per vehicle.

GEICO and MoneyGeek stress this for rural drivers, where minimums leave you exposed. Picture your EV torched in a brush fire full coverage could reimburse its $50,000 value.

Benefit 4: Enhanced Financial Security and Peace of Mind

Full coverage acts as a financial safety net, capping out-of-pocket costs in major incidents and preventing debt from unexpected repairs. In high-cost California, where medical and repair bills average $15,000 post-accident, this peace of mind is priceless, especially for families.

NerdWallet calls it essential for asset protection, reducing stress in a state with 15% uninsured drivers. Stat: Drivers with full coverage report 30% less worry about finances after claims. It’s like having a buffer against life’s bumps. Assess your needs on our coverage evaluator or via Forbes’ security guide.

Benefit 5: Rental Car Reimbursement During Repairs

Stuck without wheels after a crash? Full coverage often includes rental reimbursement, covering $30-50 daily for a loaner car up to $1,000 total, keeping your routine intact. In car-dependent California, where commutes average 30 miles, this avoids Uber bills of $200+ weekly.

Allstate and USAA tout this add-on, especially post-collision. Stat: 25% of claims involve downtime over a week. Add it via our add-ons section or learn from State Farm’s rental info.

Benefit 6: Built-In Roadside Assistance

Many full coverage policies bundle roadside aid for tows, flat tires, or lockouts saving $100-200 per incident in remote areas like the Sierra Nevada. With EV breakdowns rising 20% amid charging shortages, this is trending.

Competitors like Progressive offer it standard, preventing AAA fees. Example: Stranded on I-5? Coverage dispatches help fast. Stat: 1 in 5 drivers uses it yearly. Activate through our roadside program or US News’ breakdown tips.

Benefit 7: Gap Coverage for Leased or Financed Vehicles

If your totaled car owes more on the loan than its value, gap insurance bridges the difference vital in California, where 40% of vehicles are financed and depreciation hits hard on EVs. Average gap: $5,000 for new cars.

MoneyGeek recommends for leases, avoiding pocket payouts. Stat: Claims cover 20-30% more with gap. Include it in our financed vehicle options or via Insurance.com’s gap guide.

Benefit 8: Uninsured/Underinsured Motorist Protection

With 15-20% uninsured drivers in California, this covers your injuries and damages if hit by someone lacking coverage up to $30,000/$60,000 standard. Essential amid rising hit-and-runs.

GEICO and Bankrate call it a must-add, especially post-minimum hikes. Stat: UM claims average $20,000 in medical bills. Add via our UM checker or Castillo Law’s UM info.

Benefit 9: Medical Payments for You and Passengers

MedPay covers medical bills for you and passengers, regardless of fault up to $5,000-10,000 handy in no-fault scenarios or with high deductibles. In accident-prone California, where injuries cost $10,000+ average, it fills health insurance gaps.

NerdWallet suggests for families, covering everything from ER visits to rehab. Stat: 30% of crashes involve injuries. Integrate with our health integration tools or Allstate’s MedPay details.

Benefit 10: Compliance with Lender Requirements and Better Resale

Lenders mandate full coverage for financed cars, protecting their investment non-compliance risks repossession. Plus, it boosts resale value by showing maintained protection.

Roughly 70% of leased vehicles require it. Ensure yours with our lender compliance check or WSJ’s best CA insurers.

Conclusion:

California in 2026 remains one of the most demanding places to own and drive a vehicle. With average full coverage premiums sitting at approximately $3,119 per year (around $260 per month) and minimum liability coverage averaging $916 annually (about $76 per month), the cost difference is significant. However, value-focused providers such as Thrifty Insurance aim to help drivers manage these costs by offering competitively priced policies without sacrificing essential protection. Given the unique risks Californians face dense urban traffic in Los Angeles (where rates run up to 36% above the state average), frequent wildfires and natural disasters, rising repair costs tied to advanced vehicle technology, surging electric vehicle adoption, and a persistent percentage of uninsured drivers (estimated 15–20%) the added protection of full coverage remains far more than a luxury for most residents.

FAQs

What is the difference between full coverage and minimum coverage in California in 2026?

Minimum coverage in California includes only 30/60/15 liability insurance, which pays for injuries and property damage to others. Full coverage includes liability plus collision and comprehensive, which pay for damage to your own car from accidents, theft, wildfires, vandalism, weather, animals, and falling objects.

How much more does full coverage cost than minimum coverage in California in 2026?

In 2026, full coverage averages about $3,119 per year ($260/month), while minimum coverage averages about $916 per year ($76/month). Full coverage costs roughly $2,200 more per year, though rates vary by driver, city, vehicle, and insurer.

Is full coverage required by law in California?

No. California law only requires 30/60/15 liability coverage. Full coverage is not legally required, but lenders usually require it if your car is financed or leased.

Does full coverage pay for my car if I cause an accident?

Yes. Collision coverage, which is part of full coverage, pays to repair or replace your car after an at-fault accident, minus your deductible. Without collision coverage, you pay all repair or replacement costs yourself.

Does full coverage help if my car is damaged in a California wildfire?

Yes. Comprehensive coverage (included in full coverage) covers damage from wildfires, falling trees, ash, smoke, hail, floods, and other non-collision events. This has been especially valuable in California, where wildfire-related auto claims have increased significantly in recent years.

Categories: Auto